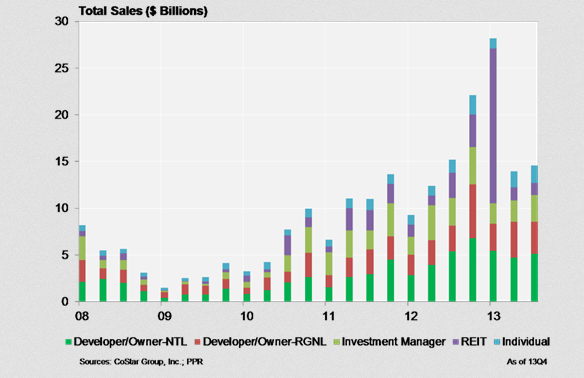

Apartment properties have been investor favorites during the last three years. However, with the pricing cycle peaking, overall transaction activity could eventually change and, with it, the buyer mix.

Signs of transaction deceleration are beginning to show. Even if last year’s volume was 20 percent higher than 2012’s, activity seemed slower during the second half of the year. For example, third quarter 2013 volume was comparable to that observed in the third quarter of 2012. This contrasts with the steady year-over-year growth observed between 2010 and 2012.

While this could have been a drop following the Archstone-AvalonBay-Equity Residential deal, preliminary fourth quarter 2013 data shows a similar pattern.

When it comes to the buyer mix, a few observations are worth noting. Leaving the first quarter of last year aside (to exclude the Archstone-AvalonBay-Equity Residential transaction), the share of REIT acquisitions shows the highest variation. REITs saw their participation in transaction volume go from 16 percent between 2010 and 2012, to 9 percent in the last three quarters of 2013.

This can certainly be a pause, while REITs ponder whether the momentum in the apartment market will continue. However, it contrasts with the share of purchases by investment managers, which averaged 23 percent between 2010 and 2012 and stayed relatively stable, at 20 percent, in the last three quarters of 2013.

One thing is sure: as the pricing cycle peaks, purchases become more selective, sales increase, and prices suffer. And although a large wave of apartment property dispositions does not seem immediate, recent purchases have come with offsetting transactions.

Investment managers acquired a reasonable share of apartment properties in 2013, but they were active sellers too. REITs were also net buyers in 2013. Yet, after excluding the Archstone-AvalonBay-Equity Residential deal, a large portion of their transactions was on the sell side, too.

Prices will also suffer if buyers become less interested in newly developed properties, especially given the large amount of units coming on line this year. REITs and investment managers have been interested in those properties, buying more than 50 percent of buildings two years old or less in 2013. But their interest can change quickly, especially as other property types become more attractive.

At this point, though, the extent to which these buying trends will affect apartment property prices is still unclear. If buyers remain interested, because capital continues to be easily available, and demand for apartments holds up, the turn of the pricing cycle will be smooth. If apartment buyers turn into large net sellers, as they prepare to target other property segments, property prices could suffer more quickly.

Noel began his real estate career as a leasing agent, closing 4 leases his 1st week on the job. Since 2006, he has personally leased over 600 homes, signed up over 1000 new owners for management, and has sold over $500 million in real estate almost exclusively to, and for the benefit of investors. As the original employee, and now Broker for HomeQwik, Noel has not only assisted in the creation and management of the company, but also in the processes that make HomeQwik #1. As an owner of 2 rental properties himself, Noel also has personal experience as an investor, and has a true passion for helping others realize their investment dreams. He continues to work on building his own real estate portfolio, and is shopping for buyers in our market every single day.

Noel began his real estate career as a leasing agent, closing 4 leases his 1st week on the job. Since 2006, he has personally leased over 600 homes, signed up over 1000 new owners for management, and has sold over $500 million in real estate almost exclusively to, and for the benefit of investors. As the original employee, and now Broker for HomeQwik, Noel has not only assisted in the creation and management of the company, but also in the processes that make HomeQwik #1. As an owner of 2 rental properties himself, Noel also has personal experience as an investor, and has a true passion for helping others realize their investment dreams. He continues to work on building his own real estate portfolio, and is shopping for buyers in our market every single day. Jason Stieglitz is a Realtor and Property Manager at HomeQwik, a firm that specializes in all aspects of Residential Property Management. Jason has been an Arizona resident for almost 40 years, and in real estate since 2009. Formerly in construction, Jason can apply some of that knowledge to maintenance problem solving with your investment property.

Jason Stieglitz is a Realtor and Property Manager at HomeQwik, a firm that specializes in all aspects of Residential Property Management. Jason has been an Arizona resident for almost 40 years, and in real estate since 2009. Formerly in construction, Jason can apply some of that knowledge to maintenance problem solving with your investment property. Mike Sargent – Founder/Real Estate Investor

Mike Sargent – Founder/Real Estate Investor Jim Hughes – IT Manager

Jim Hughes – IT Manager Janie Scarborough – Business Development Manager for Prescott/Quad City Territory

Janie Scarborough – Business Development Manager for Prescott/Quad City Territory  Gk Pavillar – Manager of HomeQwik Remote Operations

Gk Pavillar – Manager of HomeQwik Remote Operations